Are you considering rolling over your retirement plan assets from your former employer to an IRA?

A close look at the investment options that will be available through an IRA often leads participants to discover 1) the higher costs for similar investments outside of a qualified plan and, 2) a maybe not so obvious disadvantage is losing access to stable value.

Employer sponsored plans are often able to offer unique advantages and less expensive investment options but most importantly, qualified retirement plans are the only place you can access stable value solutions.

Since stable value tends to appeal the most to those approaching and in retirement, losing access to stable value just at the time when most investors would benefit the most from it, is worthwhile considering and a conversation we recommend you have with your financial advisor. The most commonly used capital preservation investment in an IRA is money market funds.

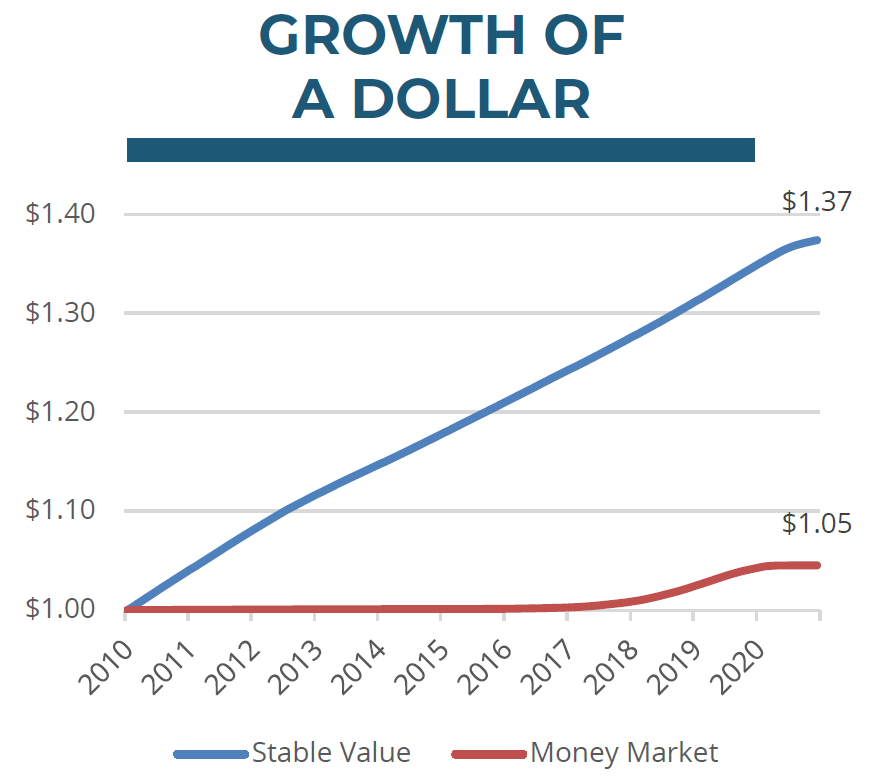

Every year thousands of Americans rollover assets from their former employers’ defined contribution plans into IRAs. Typically, they’re looking to consolidate their assets into a single account for easy and convenient management. While this may seem like a well-intended decision, many plan participants don’t realize the value of what they are giving up, such as being excluded access to an attractive investment option only found in retirement plans – stable value. There are a variety of stable value funds in the market today which are all structured to offer principal protection and consistent, positive returns similar to intermediate-term bonds and typically exceed those of money market funds. While these stable value funds may be structured and implemented differently, they all are only available in tax qualified plans such as 401(k), 401(a), 403(b), 501(a) and 457 plans. They are also available in other plan types, such as 529 tuition assistance plans and Health Savings Accounts.

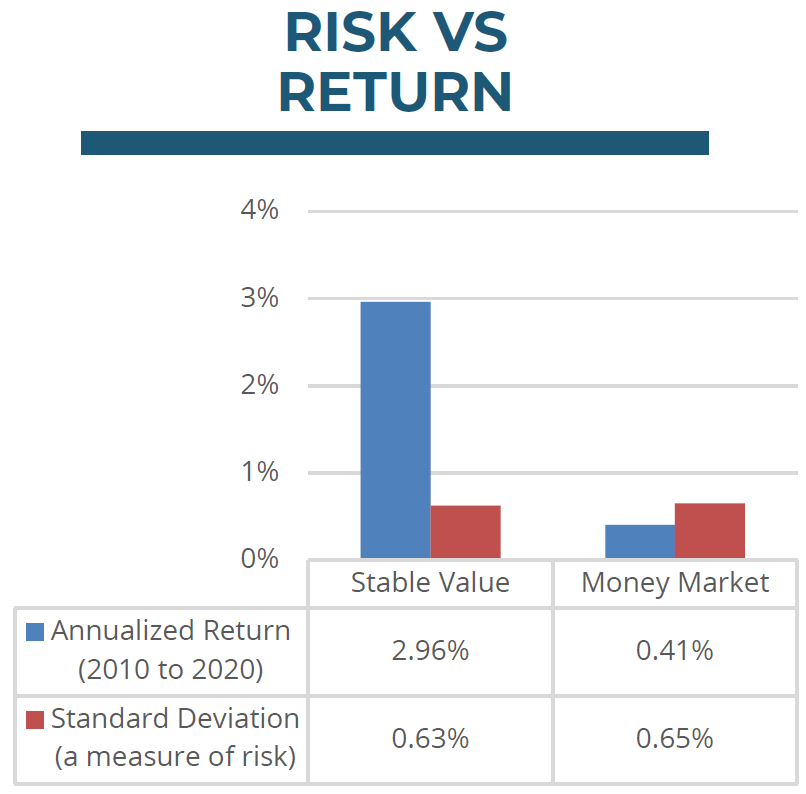

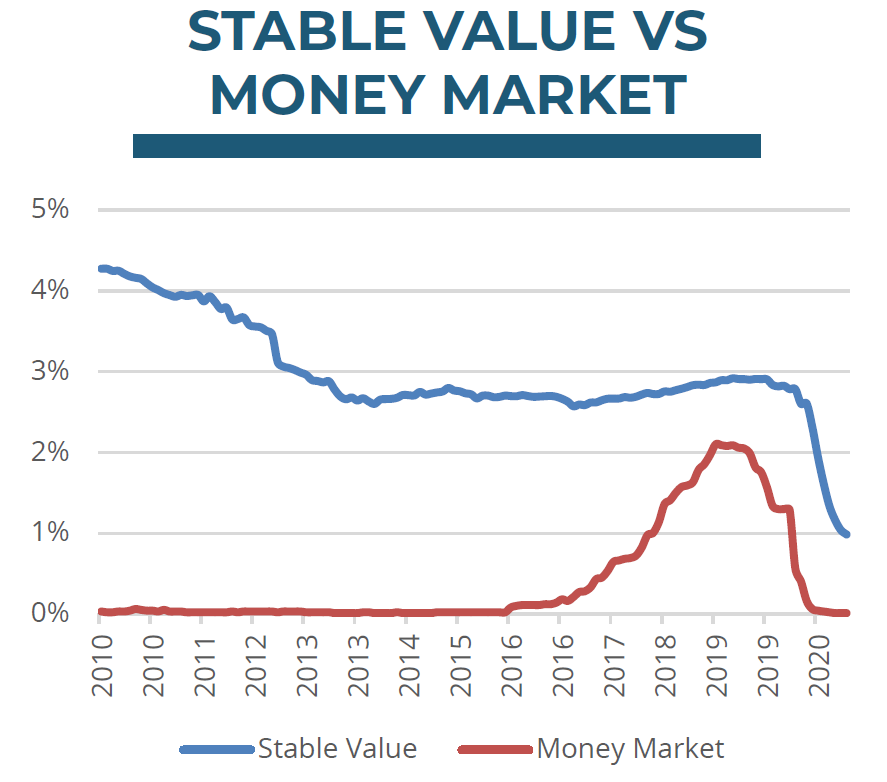

With an average annualized returns for the past 10 years of 2.96% compared to 0.41% for money market funds, in addition to lower average volatility, stable value funds are an attractive choice for those investors seeking a capital preservation component in their retirement planning.

If your employer’s retirement plan currently offers stable value, and you are considering a rollover, you might be better off leaving some portion of your retirement assets with the plan to maintain an investment in stable value. Switching to a money market within an IRA is generally going to cost more while offering little upside given the low rate environment we are in, once again. A 2.50% difference in average annual return between stable value and money market funds can be significant, especially when a retiree is now living off the investment. Understanding your choices before moving assets into a rollover IRA will help you make the decisions that are right for you.

Endnotes

“Stable Value” is a simulation of book value returns in a hypothetical fund holding intermediate bonds and stable value wrap contracts, with crediting interest rates reset monthly using the industry accepted crediting rate formula. The bond returns incorporated into the simulation are monthly market value returns from the Barclays Intermediate Government/Credit Bond Index, with gains/losses reflected in future crediting rates by amortizing market-vs.-book values over intermediate bond index durations. This simulation incorporates no ongoing cash flows into or out of the fund. Returns illustrated are gross before any fees.

“Money Market Funds” is a simulation of money market returns from the iMoneyNet MFR Money Funds Index. Returns illustrated are gross before any fees.