Introduction

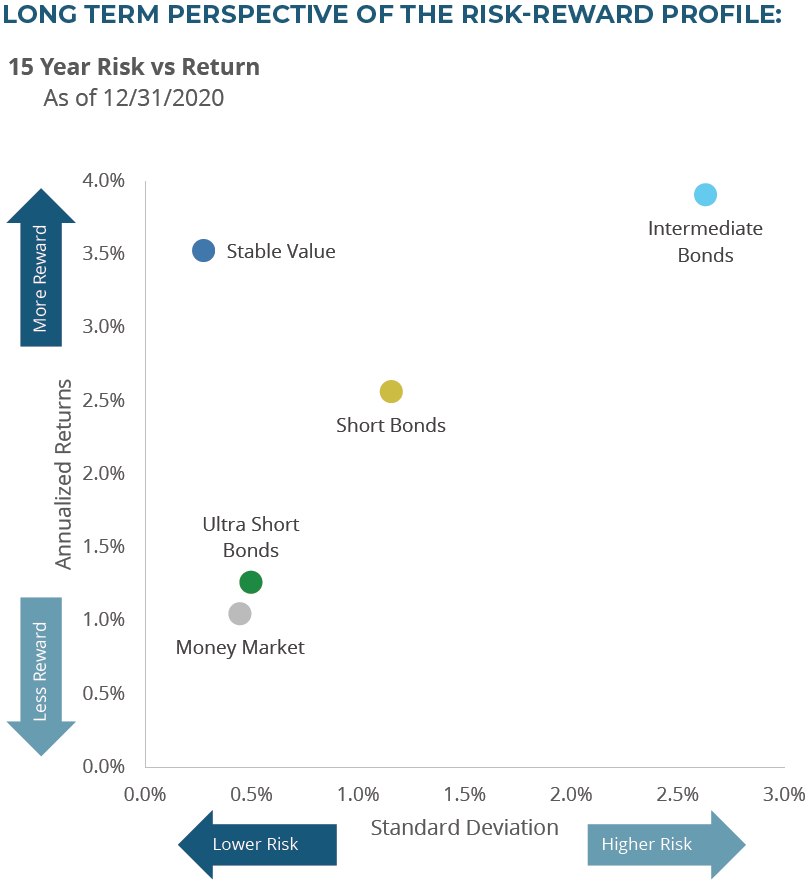

Plan sponsors have a unique opportunity to offer a stable value product which is specifically designed to meet the needs of their plan participants and can only be offered inside a tax qualified plan. Stable value has a low correlation to other asset classes while providing a distinctive combination of benefits for plan participants: principal preservation; consistent, positive returns generally higher than money market funds; and liquidity for participant benefit payments. The ability for stable value funds to provide bond-like returns with exceptionally low return volatility provides investors with an attractive risk/return profile.

Educating plan participants on the long term value of staying invested in their stable value option after retirement will help retain assets in the plan, given there are no stable value solutions available to them if they roll their retirement assets into an IRA rollover account. From our most recent paper, Who Invests in Stable Value and Why, we learned that stable value is most heavily used by individuals near and in retirement. Those same individuals will also most likely have the highest account balances. Encouraging those participants to remain invested in the plan can also benefit all participants by helping keep overall costs lower, as a higher asset base generally pays a lower expense ratio.

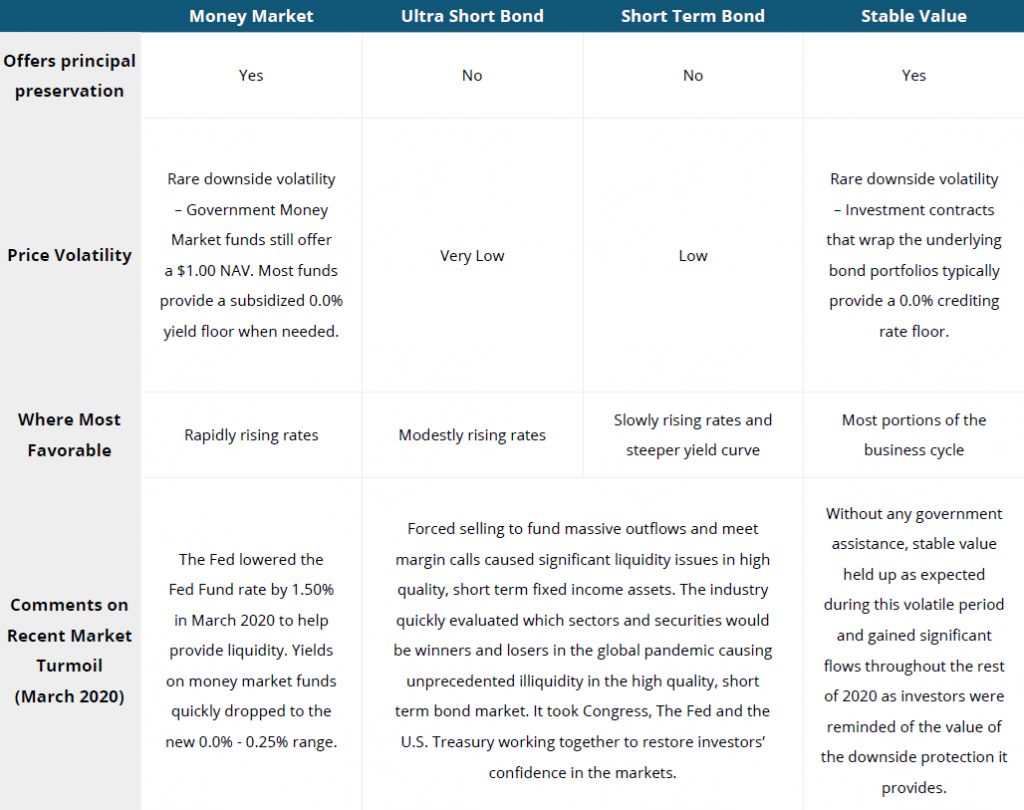

Capital Preservation Options

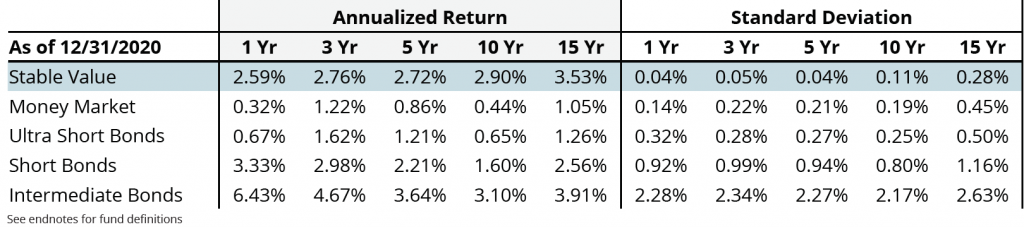

All tax qualified retirement plans are required to offer a diversified and broad range of investment options including a low-risk option. Low-risk options typically include a money market, ultra short term bond, short term bond, and stable value. Each asset class has advantages during different stages of a business cycle or during specific economic events that can cause it to outperform the others, however stable value is enduring and has historically outperformed.

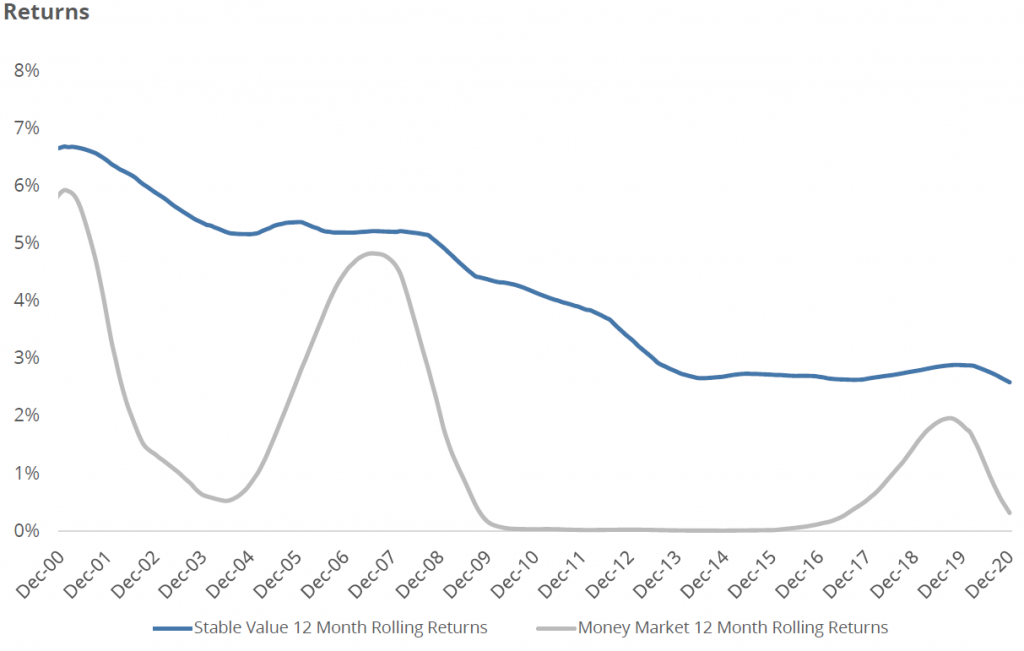

While stable value and money market are the only true principal preservation options, the 2007-2008 Financial Crisis followed by eight years of near 0% money market fund returns may tip the scales in favor of stable value. Stable value delivers consistent and generally higher returns; an annual average of 2.48% above money market funds over the last 15 years along with lower standard deviation. Although intermediate term bonds are not a capital preservation option, they are included for return comparison purposes.

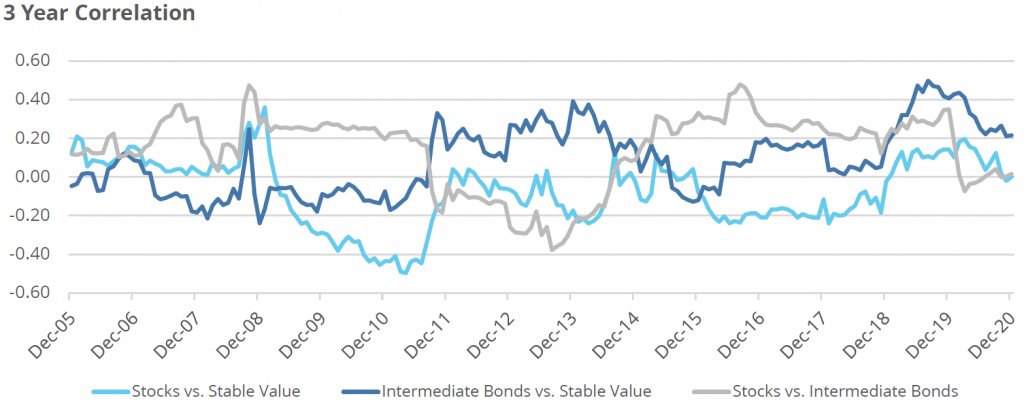

Diversification and Low Correlation

In addition to providing an attractive risk-return profile, stable value also provides a low and often negative correlation to stock and bond returns. Therefore, by adding stable value to the asset allocation model, plan participants can smooth the overall performance returns they experience. This should be particularly appealing to the risk-adverse plan participant.

Low Rate Environment

During the three short years of rising interest rates from Q4 2015 through Q4 2018, money market funds experienced increasing yields at a faster rate than stable value, but the COVID-19 global pandemic quickly reversed those three years of gains as the Federal Reserve cut the Fed Fund target rate by 1.50% in March 2020. The following graph shows higher and smoother returns for stable value relative to money markets.

As shown in the graphic above, stable value returns trend toward the current rate but migrate slower than other asset classes. In addition, stable value also benefits from the ability to invest in longer maturity bonds with higher yields, which money market funds are unable to do. Over the long term, stable value is designed to outperform money markets given their longer duration while still providing principal protection.

Stable Value Restrictions

Typically, the only restriction on a participant’s stable value transactions is a prohibition of transfers from stable value directly into another investment product that provides a similar low risk profile (which is deemed to be a competing fund) such as a money market fund. This restriction protects participants remaining in stable value by mitigating arbitrage, which would otherwise negatively impact their returns over the long term. Most recordkeepers are familiar with this restriction, and have implemented automated procedures for enforcing the restriction on individual participant transactions to competing funds.

Stable Value – There When You Need It

Stable value has always provided value – higher returns over the long term with lower volatility, with a 0% return floor. In 2020, which was a year where everything went crazy, stable value did exactly what it was supposed to do – not go crazy. It remained stable and is continuing to deliver stable returns that are very attractive relative to many other principal protected asset classes.

As demonstrated above, plan participants that rolled out of their retirement plans into an IRA, and from stable value into money market funds, have experienced significantly lower yields and total returns on those assets and higher volatility over a fifteen year time horizon.

Although the magnitude of the current stable value benefit will vary, stable value delivers a strong value proposition to risk averse plan participants. All of these reasons are what makes stable value attractive as it provides peace of mind when life throws you curve balls. Knowing your retirement money will be there when you need it is priceless.

Endnotes

For more information, we encourage you to access our library of educational content on a broad variety of stable value related topics. Visit the Stable Value Investment Association website at: https://stablevalue.org/ for more information.

“Stable Value” is a simulation of book value returns in a hypothetical fund holding intermediate bonds and stable value wrap contracts, with crediting interest rates reset monthly using the industry accepted crediting rate formula. The bond returns incorporated into the simulation are monthly market value returns from the Barclays Intermediate Government/Credit Bond Index, with gains/losses reflected in future crediting rates by amortizing market-vs.-book values over intermediate bond index durations. This simulation incorporates no ongoing cash flows into or out of the fund. Returns illustrated are gross before any fees.

“Money Market” is a simulation of money market returns from the iMoneyNet MFR Money Funds Index. Returns illustrated are gross before any fees.

”Intermediate Bonds” is a simulation of market value bond fund returns from the Barclays Intermediate Government/Credit Bond Index. Returns illustrated are gross before any fees.

“Stocks” is the S&P 500 Index with dividends reinvested: a widely used barometer of U.S. stock market performance; as a market-weighted index of leading companies in leading industries, it is dominated by large-capitalization companies. Returns illustrated are gross before any fees.

“Short Bonds” is a simulation of market value bond fund returns from the Bloomberg Barclays U.S. Government & Credit 1-3 Year Index. Returns illustrated are gross before any fees.

“Ultra Short Bonds” is a simulation of returns from the Bloomberg Barclays U.S. Treasury Bellwethers (3M) Index. Returns illustrated are gross before any fees.

Disclaimer: The performance data shown represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance data cited. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.