By: Randy Myers

It’s easy to see why much of America has acquired a skeptical view of the financial services industry. Over the past dozen years, Wall Street has been rocked by accounting improprieties, the bursting of the tech-stock and real estate

bubbles, the Bernie Madoff scandal, and a credit crisis that prompted landmark bankruptcies in the banking and insurance sectors. “This series of events created a wave of discontent that caused Washington policymakers and the public to take a jaundiced view of all things financial,” SVIA president Gina Mitchell told participants at the SVIA’s annual Spring Seminar in Scottsdale, Arizona. The result is that much like Caesar’s wife, financial services firms and their products are expected to not only operate in accordance with the law but also be above suspicion. Fortunately, Mitchell said, the stable value industry has performed with distinction, generating stable and positive returns throughout the most recent financial crisis and its aftermath. During that period, it consistently outperformed money market funds.

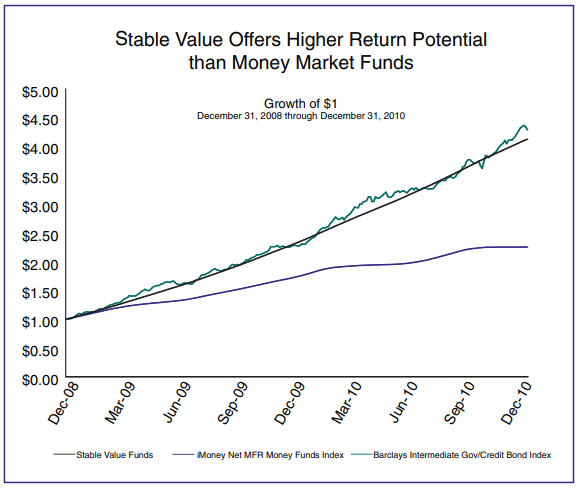

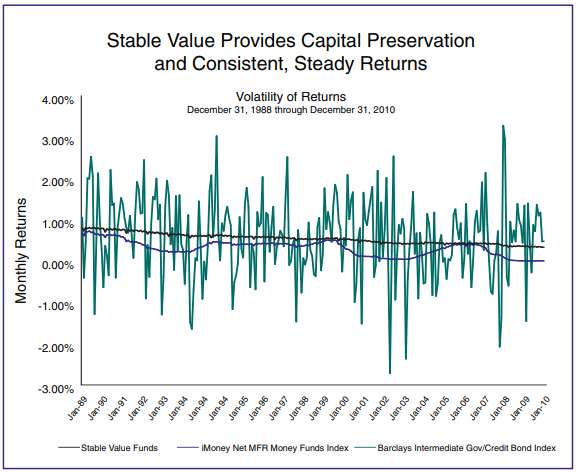

In fact, Mitchell noted, stable value returns have nearly matched those available from intermediate-term bond funds,

not just recently but over the past 22 years. It has performed well by also insulating investors from increased volatility.

From the end of 1988 through the end of 2010, Mitchell said, a $1 investment in money market funds would have grown to $2.25, while a $1 investment in a model stable value account would have grown to $4.08. A comparable investment in the Barclays Intermediate Government/Credit Index would have grown only slightly more, to $4.34. “Despite some skepticism, stable value has worked,” Mitchell concluded. “Investors have reacted to this positively. They have sought out stable value funds and they have stayed in them.”