An increasingly unpredictable market has heightened attention on stable value funds. With $902 billion in assets, stable value funds represent 8% of defined contribution plan assets based on the Investment Company Institute’s Retirement Plan Assets as of first quarter 2022. This FAQ is intended to answer frequent questions on stable value given the increased attention and prominence of this investment option in defined contribution plans.

Why the interest in stable value funds?

Participants invest in stable value funds for their unique combination of benefits:

- Principal preservation,

- Stability and steady growth in principal and earned interest,

- Benefit-responsive liquidity, which means participants transact at contract value (principal plus accrued interest).

Over the long term having returns similar to intermediate-term bonds while providing principal preservation and daily liquidity for participants makes stable value an attractive investment, particularly during times of volatility.

Who invests in stable value funds?

Based on data from ten major plan administrators to break down in detail $4.5 trillion in assets from nearly 135,000 plans covering 42 million participants from 2010 to 2019, SVIA found 63% of all plan participants were offered stable value. When considering the population of participants to whom stable value is offered, 22-28% of all participants that had access to a stable value option allocated some of their assets to stable value.

This data shows that stable value investors are predominantly older with those 50 and older owning approximately 85% of stable value assets. This data supports the importance of stable value to those plan participants who are nearing or in retirement. However, stable value also has value for younger investors as well. About 20% of participants who invest in stable value are 39 and younger, representing 3.5% of total assets in the analysis. Stable value is a great “all weather” solution, as it has withstood the test of time through many challenging market cycles over the past 50 years. The consistent, low volatility returns make stable value a reliable source of retirement income as well as a safe option to provide downside protection, especially during periods of market volatility.

Why do plan sponsors offer stable value funds as an investment option?

Stable value’s ability to provide bond-like returns with exceptionally low return volatility, principal preservation, and low correlation to other asset classes makes stable value funds an essential investment option for participant-directed retirement and savings plans.

Further, most defined contribution plans have fiduciary requirements that require the plan sponsor to offer an array of investment options with different risk/reward characteristics. This enables investors/participants to build a diversified portfolio of assets to achieve their investment goals and objectives.

How do stable value funds respond to changes in interest rates?

The crediting rates of stable value funds generally follow market interest rate trends (as rates both rise and fall), but with a lag. In a rising interest rate environment, the mechanism for calculating crediting rates is designed to amortize marked-to-market losses that would normally be realized immediately in a bond portfolio’s market value. A stable value fund’s underlying bond portfolio is expected to gradually recover these unrealized market value losses as its bonds mature, continuing to capture incrementally higher yields (as well as maturity and credit/structure risk premiums) as cash flows are reinvested. The insulation from volatility and the ability to take advantage of reinvestment rates together form the foundation of a stable value fund’s primary value proposition.

How are stable value funds similar?

All stable value funds offer the same unique combination of benefits: principal preservation; stability and steady growth in principal and earned interest; returns similar to intermediate bond funds over the long term; and daily liquidity for participants (also known as benefit responsiveness). All stable value funds have an investment contract(s) that provides benefit responsiveness backed by a portfolio of assets. Stable value investment contracts are issued by insurance companies and banks. They are as meaningful as the insurance contracts for your home, apartment, or car. They are much more than just a “piece of paper.”

How are stable value funds different from one another?

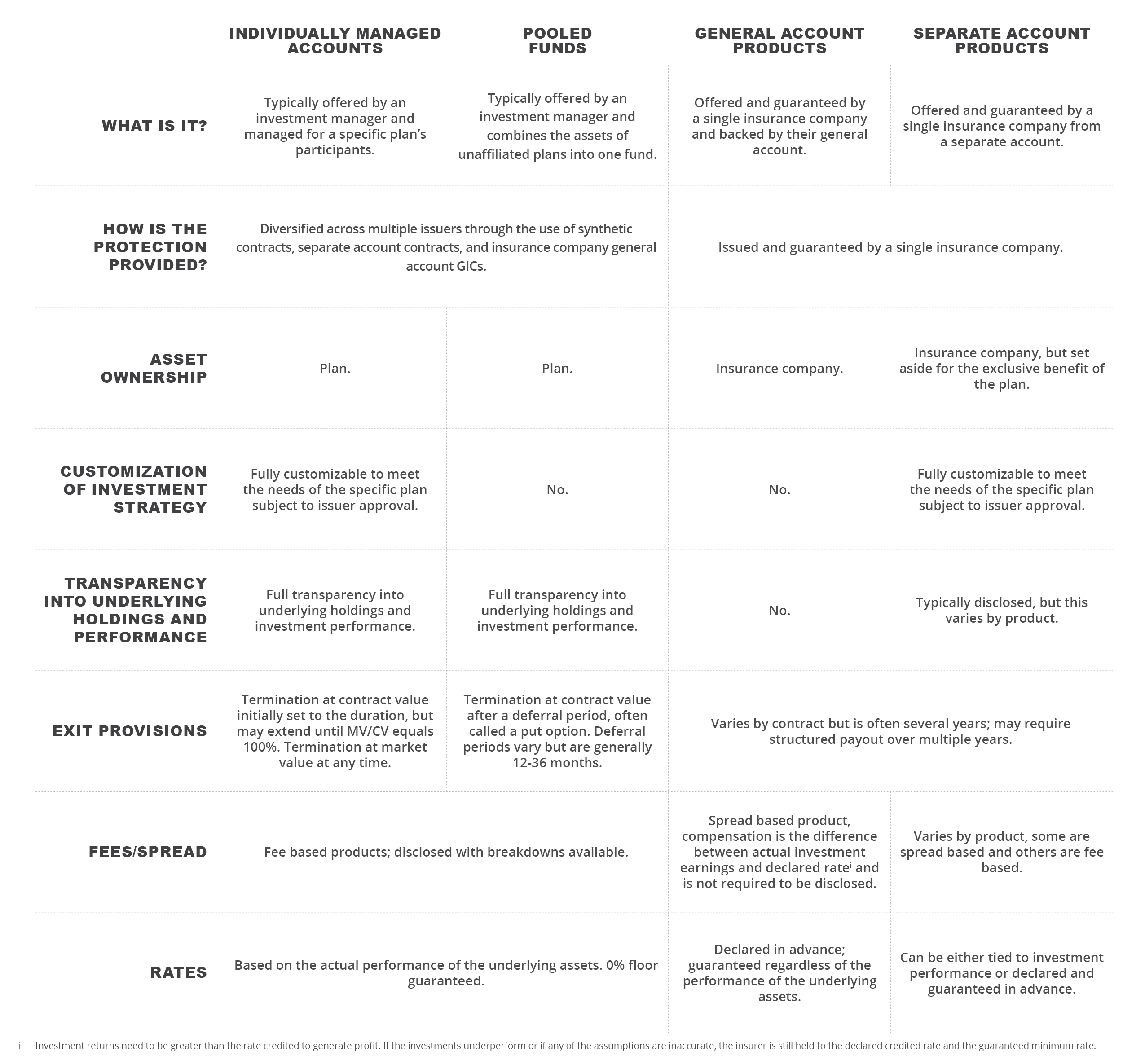

There are four types of stable value funds: individually managed accounts, pooled funds, general account products, and separate account products. It is the responsibility of the plan sponsor to select the type of stable value funds that best fits the needs of their plan participants. Stable value funds may be constructed from a combination of general account contracts, separate account contracts, and synthetic guaranteed investment contracts (GIC) in their stable value fund. Individually managed accounts and pooled funds are the two types of stable value funds that primarily utilize synthetic GICs.

A synthetic GIC is issued by an insurance company or a bank and provides the benefits of a stable value fund. A synthetic GIC includes an asset ownership component and a contractual component that provides benefit responsiveness (principal plus accrued interest or contract value). The associated assets backing the synthetic GIC are owned and held in the name of the plan, the plan’s trustee, or a commingled investment trust (CIT).

One of the four types of stable value funds is known as an individually managed account. These accounts are managed by an independent investment management firm or by employees or affiliates of the plan sponsor. Individually managed accounts allow for a higher degree of customization than other stable value funds. The account purchases stable value investment contracts from multiple issuers and other investments on behalf of the plan. These accounts are available to plans with substantial stable value assets, however, minimum account size varies by firm. They typically primarily invest in synthetic GICs.

Another type of stable value fund is a pooled fund, also known as commingled investment trust or CIT. A pooled fund combines the assets of multiple unaffiliated plans into one large group. Pooled funds are used by plans that do not meet the minimum size for an individually managed account or do not require plan specific customization. Like individually managed accounts, the pooled fund purchases stable value investment contracts from multiple issuers and other investments on behalf of the plan, but pooled funds permit unaffiliated plans to collectively invest their assets. Most stable value pooled funds primarily invest in synthetic GICs.

Another type of stable value fund is a general account product, which consist of a stable value investment contract (usually a group annuity) issued by an insurance company and whose assets are invested in and owned by the insurance company’s general account. This means that the entire general account of the insurance company, and effectively the ultimate claims paying ability of the insurer, supports the stable value guarantee. The assets in an insurance company’s general account are not attributable to any single policyholder or liability, and the Employee Retirement Income Security Act (ERISA) excludes the assets supporting these guaranteed insurance accounts from the definition of plan assets and treatment as plan assets if they are guaranteed benefit policies.

A separate account product is another type of stable value fund. Like general account products, separate account products consist of a stable value investment contract issued by an insurance company; however, separate account products differ from general account products in that their assets are segregated from the general account of the insurer. As the name suggests, this means that assets in the separate account are dedicated for the purposes of supporting the obligations of the contract. Only if the separate account assets are insufficient to meet the contract’s obligations would the insurance company making the guarantee take assets from its general account to make up a shortfall.

The following table provides an overview on the types of stable value funds.

How are stable value funds regulated?

The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets standards for private employer retirement plans to protect individuals in these plans. Similar laws exist for plans sponsored by state and local governments.

Further, stable value funds, contract providers, investment managers, and other service providers involved in stable value funds have multiple layers of regulatory oversight provided by a variety of federal and state governmental regulatory bodies as well as by nongovernmental bodies.

Are there rules or restrictions that apply to plan participants for investing in their stable value fund?

Yes, there usually is a prohibition on direct transfers from a stable value fund into another investment option that provides a similarly low risk profile (which is deemed to be a competing fund) such as a money market fund. To prohibit transfers to competing funds, a stable value fund may require an “equity wash,” which requires participants to first transfer their money to a non-competing investment option for a period of time, typically 90 days. This restriction reduces the risk of arbitrage, thereby protecting participants and stable value fund returns over the long term.

Are there rules or restrictions that apply to plan sponsors offering a stable value fund?

Plan sponsor exit provisions are stipulated in the contract between the stable value investment contract issuer and the plan sponsor. They generally require the plan sponsor to wait a stated period before receiving contract value (principal plus accumulated interest). If a plan sponsor does not wish to wait, the plan sponsor may be able to redeem the assets in the stable value fund immediately at current market value, which may be less than contract value. This may result in plan participants not having their principal preserved. Exit provisions vary by the product type used by the stable value fund and are specified in the stable value investment contract.

What are stable value fees?

Issuers of stable value investment contracts are compensated for the assurances made to the stable value fund. This charge can be either fee-based or spread-based. Synthetic GICs and separate account product types customarily charge and disclose fees that can be easily compared across providers. General account products typically do not disclose an explicit fee but instead are structured to provide the issuer the opportunity to earn a spread on the yield of the underlying assets over the crediting rate guaranteed to participants.

Because the supporting investments for general account products are managed collectively in the insurer’s general account and are not earmarked to a specific liability, a spread is charged. The spread that may or may not be earned by the insurer is not fixed, subject to change, and is not known until after the expiration of the rate guarantee period. As a result, the spread cannot be easily attributed for purposes of disclosure. The spread also varies based on the insurer’s specific structure of underlying assets, contract terms, capital requirements and overall experience.

How can I learn more or monitor a stable value fund?

To learn more about your plan’s stable value fund, check out your plan’s stable value fund fact sheet. That fact sheet is like a prospectus and is usually provided on a quarterly basis.