A number of important metrics suggest American workers should be in a good place financially. Unemployment levels are near historic lows. Participation rates in 401(k) plans are up, and according to Alight Solutions, a provider of benefits administration and human resources services, the average 401(k) account balance grew nearly 38% over the past eight years, from $76,000 in 2010 to $104,600 in 2018.

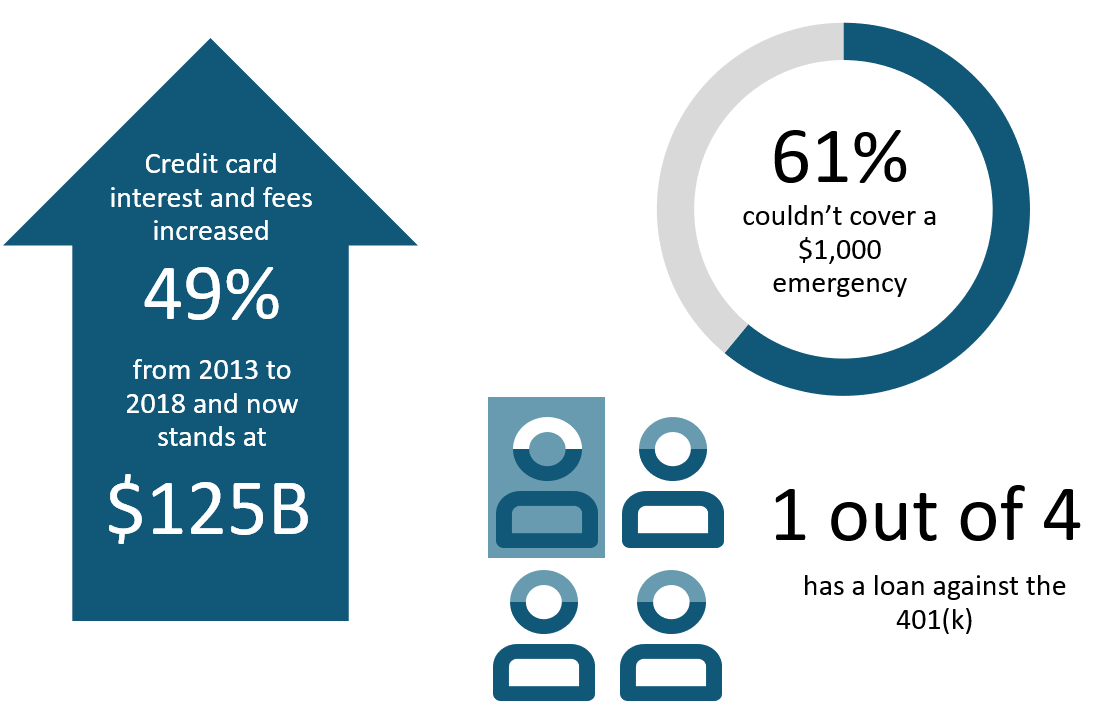

But as Anthony DePalma, a senior research manager at Alight, noted at the 2019 SVIA Fall Forum, those numbers mask some more disturbing statistics. According to one recent survey, 61% of American workers couldn’t cover a $1,000 emergency. One in four has a loan against their 401(k) account. And Americans collectively are awash in debt; credit card interest and fees rose 49% from 2013 to 2018 and now stand at $125 billion.

To find out how workers feel about their financial situation—and how employers are responding—Alight recently surveyed more than 2,500 workers across the country, as well as nearly 175 employers with retirement plans covering 7.6 million employees.

The first survey revealed that workers value their financial wellbeing as much as, or more than, other types of wellbeing. Seventy-five percent say financial wellbeing is very important, ahead of mental and emotional wellbeing (cited by 74%), physical wellbeing (71%), professional and career wellbeing (71%), and social wellbeing (47%).

Unfortunately, only 34% of workers rate their financial wellbeing high, and even more (36%) say living a truly healthy life requires more time, attention and/or money than they are willing to spend.

“A very sizeable amount of people are saying, ‘This is too tough. I can’t afford the lifestyle I truly want to be healthy,’” DePalma said, noting that this sentiment has increased by 15 percentage points over the past five years.

Alight also found that 20% of workers say they are struggling to meet their monthly expenses, and 25% say debt is ruining their quality of life. Only 28% say they’re actually covering current expenses, managing their debt, and saving and investing for future needs. A majority (56%) say most of their stress comes from finances.

Perhaps not surprisingly, then, a large majority of workers appreciate any help they can get from their employers. Eighty percent say financial wellbeing programs are a good business investment. Seventy-eight percent say the programs make them feel better about their employers, 75% say the programs are effective in helping them create a better financial future, and 70% say they are one of the reasons they stay at their job.

Employers are getting the message. Asked recently which of four initiatives they are likely to address, 65% of the employers said creating or focusing on financial wellbeing, up from 52% in 2018. That outpaced three other options listed: measuring the competitive position of their retirement program (cited by 47%), projecting the expected retirement income adequacy of their worker population (33%), and implementing initiatives to address the retirement savings gap (28%).

The top reasons cited for expanding financial wellbeing benefits was to enhance the overall employee experience (cited by 84% of employers), but that was closely followed by a belief that it is the right thing to do (82%).

To be sure, broadly designed and implemented financial wellbeing programs are still a relatively new employee benefit, even as they are becoming increasingly popular. Only 8% of surveyed employers say they have a program fully implemented. But 27% say they have created a financial wellbeing strategy and are in the process of executing on it (up from 16% in 2017), and another 53% say they’re in the process of creating a strategy. Only 12% say they do not intend to create one.

The most popular financial wellbeing offerings among employers who have programs right now are those that help employees understand the basics of financial markets and simple investing (offered by 50% of employers), budgeting tools (44%), health care education and planning (39%), and financial planning (38%). Trailing slightly are debt management tools (32%), programs to help employees prioritize saving (31%), and assistance with saving for life stages (25%).

Very few employers offer assistance with student loan repayment, but 11% say they’re likely to offer it, and 41% say they are moderately likely to do so. More popular are student loan consolidation aids (offered by 17%), and tools to facilitate saving for college (14%).

While few employers have yet made much headway trying to calculate a hard return-on-investment for their financial wellbeing programs, a majority (76%) say they will track the extent to which employees use their benefits, 58% will track employee engagement, and 51% will monitor retirement statistics to see if they are improving. Twenty-one percent also say they’ll be monitoring medical costs.

DePalma said the survey results paint a picture of American workers who need help with their finances and want help from their employers—and of employers who want to help their workers. That is evidenced, he said, by the fact that three out of four employers either have a wellbeing program or are providing workers with some resources and education on financial issues.