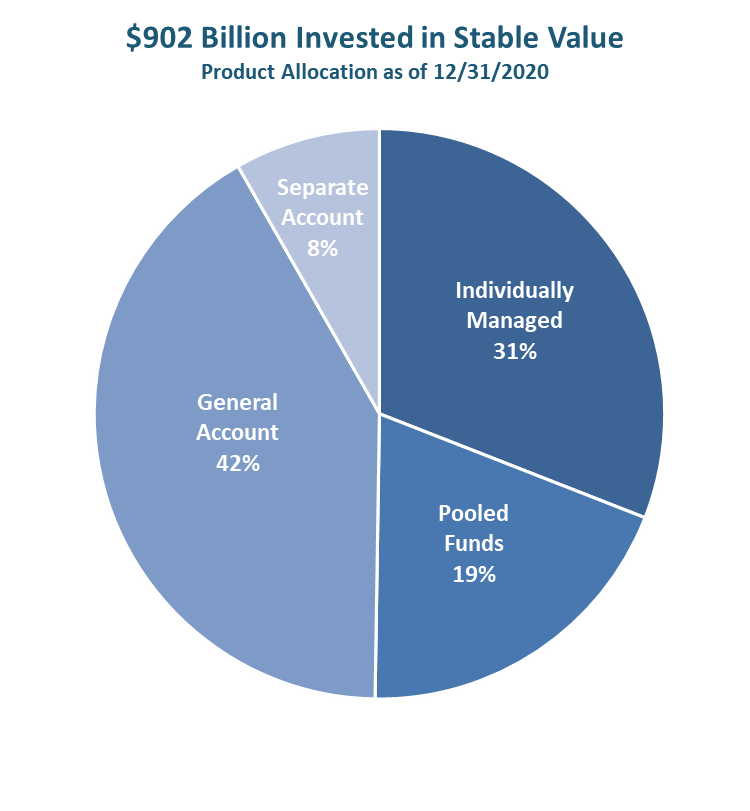

Given the complexity and uncertainty of today’s financial markets and economy, it is no wonder that plan sponsors and participants continue to appreciate the benefits of stable value. As of December 31, 2020, more than 185,000 defined contribution plans invested $902 billion in stable value products.[i] Throughout its 45 year history, stable value has consistently delivered a unique combination of benefits: liquidity, principal preservation, and consistent, positive returns.

Stable value funds are tailored to meet the needs of a specific plan participant population and/ or group of plans and their plan participants. While all stable value funds have weathered various economic cycles and consistently performed in meeting the needs of plan participants, there are differences in structure, levels of guarantees, as well as some contractual features. Because of the significant allocation of assets to guaranteed insurance accounts and the scant amount of publicly available information, the following frequently asked questions (FAQ) seeks to shed some light on this segment. This FAQ is limited to an overview of guaranteed insurance accounts and focuses primarily on ‘spread-based’ general account insurance products. The FAQ does not address all the variations of guaranteed insurance accounts or the combination of stable value funds that may be used by a plan. This FAQ also does not discuss or compare other stable value segments such as individually managed or pooled funds or differences in investment management.[ii]

What is a stable value guaranteed insurance account?

Guaranteed insurance accounts are stable value funds that are offered to defined contribution plans such as 401(k), 401(a), 457, 403(b) and some 529 tuition assistance plans, generally managed entirely and guaranteed directly by a single insurance company.

What are some other aspects of guaranteed insurance accounts that a plan sponsor should consider?

Consider asset ownership, single guarantors, disclosure requirements, fees/spread, and exit terms.

What are the strengths of guaranteed insurance accounts?

In addition to providing an attractive solution to plans and participants seeking stability, liquidity, and yield, guaranteed insurance accounts provide the following benefits:

What risks does the insurer bear for providing the guarantees?

By declaring a rate that can never fall below the guaranteed minimum interest rate in advance, the insurance company assumes certain risks.

How does an insurer take on these risks?

Transferring risk from policyholders to the insurance company is at the very heart of what insurance companies do every day.

What are the differences between general accounts and separate accounts?

Guaranteed insurance accounts can be structured in two ways: general accounts or separate accounts.

How can a plan get comfortable with a single guarantor behind a guaranteed insurance account?

Aside from the fact that any claims related to guaranteed insurance accounts are pari-passu with policyholders and ahead of general creditors, insurance companies are highly regulated with rigorous risk management and oversight processes.

[i] SVIA 2020 Annual Investment & Policy Report

[ii] For more information about stable value segments other than guaranteed insurance accounts, please see www.stablevalue.org.