The long-anticipated rise in interest rates may finally be at hand.

Wall Street—and the stable value community—spent much of the past few years anticipating an uptick in interest rates that never materialized. But last year the Federal Reserve ended the bond-buying program it had been using to keep a lid on long-term rates, and later this year it is widely expected to start pushing short-term rates higher. Once again, retirement plan sponsors and consultants are wondering what the impact will be on stable value funds.

The short answer is that the impact will likely be modest. In the near term, rising rates could lead to some declines in stable value funds’ underlying investment portfolios, which could drop the market value of those portfolios below their book value. But LeAnn Bickel, head of stable value contract administration for Invesco Advisors Inc., notes that many stable value providers have had experience with market-to-book ratios falling below par without major consequences. “We know it’s a function of the mechanics of the product, and not that big of a deal since market-to-book ratios are typically fluid,” she said, kicking off a roundtable discussion of the issue at the 2015 SVIA Spring Seminar.

Bickel noted that one potentially complicating factor in the current environment is that many stable value funds have been experiencing flat or negative cash flows as participants become increasingly comfortable with channeling more of their money into the stock market, which has been in an uptrend for the past six years. How might stable value funds be impacted if cash flows remained negative in a rising rate environment?

Timothy Grove, vice president-retirement with Prudential Financial, said it would not be surprising to see stable value crediting rates decline if there are net or participant withdrawals when market value is below book value. “And while we all expect rates to go up—and that’s the closest I’ll come to making a prediction—we don’t know when,” he cautioned. “We’ve thought that for a number of years now, and it hasn’t happened.”

To shed some light on how stable value managers might work through a rising-rate environment, Grove explained how Prudential manages its evergreen general account stable value products. “Our general account product strives, of course, to generate competitive crediting rates for plan participants,” Grove said. “Otherwise, we’re not going to have money to manage.” But he said Prudential also works hard to manage liquidity so that it can meet cash flow needs, and pays close attention to the responsiveness of its products to changes in interest rates, money market yields, and competitors’ spot-rate products. “We also, at the end of the day, want to have a profitable product, so we’re trying to figure out the right investment strategy to be all of those things,” he said. “What we’ve landed on is essentially a laddered-maturity portfolio that consists of a meaningful allocation to commercial mortgages and private placements.” Having a laddered portfolio of investments, he said, means that Prudential always has a significant amount of money maturing at book value to help meet liquidity needs. Or, he added, that money also can be used to reinvest in new securities, which can help Prudential keep pace with interest rates in a rising-rate environment.

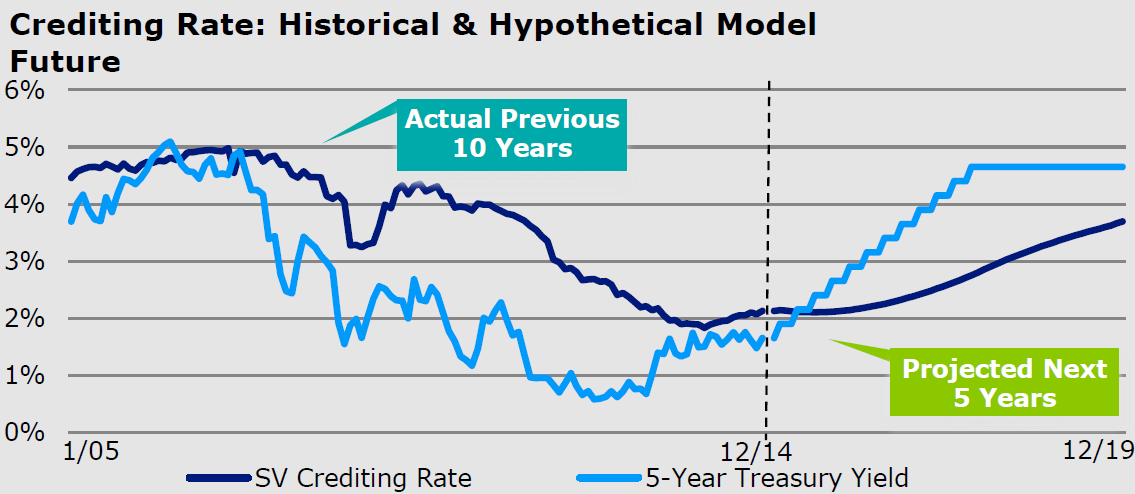

Michael Leonberger, portfolio manager with Invesco Advisors Inc., noted that stable value portfolios in general have grown more conservative since the 2008 financial crisis and should now be more responsive to interest-rate changes than they were in the past. He shared a graph showing how stable value crediting rates might respond, hypothetically, if the yield on five-year Treasury bonds shoots up 25 basis points every quarter for the next three years. After holding above five-year Treasury yields for the past decade, crediting rates would lag as interest rates turned up, the analysis showed. At the same time, market value-to-book value ratios for stable value funds would fall below 100 percent for a couple of years—to about 95 percent—before starting to climb back up.

Asked if he was concerned about interest rates continuing at their current lows for a long period of time, Thomas Schuster, vice president, stable value investment products for MetLife, reminded seminar participants that stable value funds appeal to conservative investors who typically are more concerned with safety of principal than maximizing returns. “If the prevailing interest rate environment is lower,” he said, “it’s going to be lower for the alternatives, as well. I still believe stable value produces superior outcomes over other alternatives. We’re still in a good spot, but I do think we’ll experience additional negative cash flows.” He encouraged plan sponsors, wrap providers and stable value managers to take a long-term view of stable value, and said he would be concerned if a low-rate environment prompted stable value managers to embrace riskier investment strategies in search of yield. “Regardless of the interest-rate environment, there’s a need to take that long-term view and manage the portfolios appropriately,” he said.

All the panelists agreed that it also is important to manage expectations of plan sponsors and plan participants.

“Stable value provides principal preservation for participants transacting at book value and a steady, stable rate of return,” Bickel summarized. “It’s worked in all market cycles and all interest rate environments, and I think stable value is set to continue doing that in the future.”